Partner CenterFind a Broker

Like synchronized swimmers, some currency pairs move in tandem with each other.

And like magnets of the same poles that touch, other currency pairs move in opposite directions.

When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of yourRISK EXPOSURE

When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of yourRISK EXPOSURE

You might believe that you’re spreading or diversifying your risk by trading in different pairs, but you should know that many of them tend to move in the same direction.

By trading pairs that are highly correlated, you are just magnifying your risk!

Correlations between pairs can be strong or weak and last for weeks, months, or even years. But always know that they can change on a dime.

Staying up-to-date with currency correlations can help you make better decisions if you want to leverage, hedge, or diversify your trades.

A fewthings to remember…

Coefficients are calculated using daily closing prices.

Coefficients are calculated using daily closing prices.

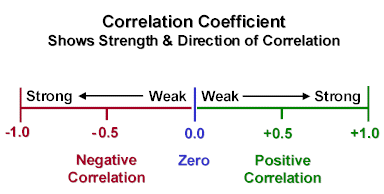

Positive coefficients indicate that the two currency pairs are positively correlated, meaning they generally move in the same direction.

Negative coefficients indicate that the two currency pairs are negatively correlated, meaning they generally move in opposite directions.

Correlation coefficient values near or at +1 or -1 mean the two currency pairs are highly related.

Correlations can be used to hedge, diversify, leverage up positions, and keep you out of positions that might cancel each other out.

Currency Pairs that Typically Move in the SAME Direction

- EUR/USD and GBP/USD

- EUR/USD and AUD/USD

- EUR/USD and NZD/USD

- USD/CHF and USD/JPY

- AUD/USD and NZD/USD

Currency Pairs That Typically Move in the OPPOSITE Direction

When you find yourself wanting to trade two pairs that are highly correlated, it’s okay if you take both setups.

Just make sure you have rules in place when you traded correlated pairs and always stick to your risk management rules!

FAQs

Currency correlation: Trading tips

How to use correlation in forex trading? ›

You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each other. In the conventional sense, you would open two of the same positions if the correlation was positive, or two opposing positions if the correlation was negative.

Which currency pair is most profitable in forex? ›

The EUR/USD pair holds the throne as the most traded forex pair globally, known for its liquidity and stability. Traders often turn to this pair for its reliability and consistent profit opportunities.

What are the correlation trading strategies? ›

This article gives an overview of and analyzes the most popular correlation trading strategies in financial practice. Six correlation strategies are discussed: 1) empirical correlation trading, 2) pairs trading, 3) multiasset options, 4) structured products, 5) correlation swaps, and 6) dispersion trading.

Which currency pairs move together? ›

Currency Pairs that Typically Move in the SAME Direction

- EUR/USD and GBP/USD.

- EUR/USD and AUD/USD.

- EUR/USD and NZD/USD.

- USD/CHF and USD/JPY.

- AUD/USD and NZD/USD.

Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, are characterized by high liquidity. This makes them suitable for scalping strategies as traders can quickly enter and exit positions without significant slippage.

Is correlation trading profitable? ›

If two assets have a strong positive correlation, it may be possible to profit from changes in the value of one asset by trading the other.

What pairs move 100 pips a day? ›

The AUD/JPY, AUD/USD, CAD/JPY, NZD/JPY, GBP/AUD, USD/MXN, USD/TRY, and USD/ZAR move the most pips daily but are not the most liquid currency pairs. Among highly liquid currency pairs, the EUR/USD and the GBP/USD move between 70 to 120 pips daily, followed by the USD/CHF and the USD/JPY.

What is the hardest forex pair to trade? ›

The 10 most volatile forex pairs (USD)

- USD/ZAR - Volatility: 12.9% ...

- AUD/USD - Volatility: 9.6% ...

- NZD/USD - Volatility: 9.5% ...

- USD/MXN - Volatility: 9.2% ...

- GBP/USD - Volatility: 7.7% ...

- USD/JPY - Volatility: 7.6% ...

- USD/CHF - Volatility: 6.7% ...

- EUR/USD - Volatility: 6.6%

Three most profitable Forex trading strategies

- Scalping strategy “Bali” This strategy is quite popular, at least, you can find its description on many trading websites. ...

- Candlestick strategy “Fight the tiger” ...

- “Profit Parabolic” trading strategy based on a Moving Average.

Top 10 Most Popular Trading Strategies

- Trading Strategy #1 – Buy and Hold. ...

- Trading Strategy #2 – Value Investing. ...

- Trading Strategy #3 – Swing Trading. ...

- Trading Strategy #4 – Momentum Trading. ...

- Trading Strategy #5 – Scalping. ...

- Trading Strategy #6 – Day Trading. ...

- Trading Strategy #7 – Positions Trading.

Types of Correlation

- Positive Linear Correlation. There is a positive linear correlation when the variable on the x -axis increases as the variable on the y -axis increases. ...

- Negative Linear Correlation. ...

- Non-linear Correlation (known as curvilinear correlation) ...

- No Correlation.

Correlation is a statistical technique which shows whether and how strongly two continuous variables are related.

How to use correlation in forex? ›

You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each other. In the conventional sense, you would open two of the same positions if the correlation was positive, or two opposing positions if the correlation was negative.

Which forex pairs do not correlate? ›

If you open a long position in EUR/USD but the markets fall, you can quickly open a short position in USD/CHF to hedge the risk. These pairs have no relationship with one another and do not affect each other's movement. An example of non-correlated currency pairs is EUR/USD and GBP/NZD.

Which currency pair fluctuates the most? ›

Majors are forex pairs including the US dollar and six other currencies which make up the vast majority of traded pairs. While EUR/USD boasts the most trading volume by far, these three commodity currency major pairs, AUD/USD, CAD/USD and NZD/USD are the most volatile major pairs and as such received a lot of interest.

How do you use correlation coefficient in trading? ›

One-way traders can use a correlation coefficient is to look for a high positive or negative correlation between an asset they want to own and the asset they can own and use the former one as a proxy. For example, many foreign exchange traders don't have access to the US Dollar Index (DXY).

How do you use correlation in trading view? ›

This portion can be done in three steps as well.

- Calculate the Variance for both securities. Variance = Squared Average - (Average Value * Average Value) ...

- Calculate the Covariance of the securities. ...

- Calculate the Correlation Coefficient.Correlation Coefficient = Covariance / SQRT(Security1 Variance x Security2 Variance)

Understanding Correlations in Options Trading: Correlation in options trading involves assessing the connection between the price movements of two or more underlying assets. It aids in understanding how changes in one option's price may impact another option or underlying security.

What is the correlation hedging strategy in forex? ›

Forex Correlation Hedging Strategy is another popular method, which involves opening the long and short positions in two positively correlated currency pairs. Alternatively, traders can open 2 long or short trades, using two negatively correlated pairs.

When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of yourRISK EXPOSURE

When you are simultaneously trading multiple currency pairs in your trading account, the most important thing is to make sure you’re aware of yourRISK EXPOSURE Coefficients are calculated using daily closing prices.

Coefficients are calculated using daily closing prices.